At Michigan, the Center on Finance, Law & Policy brings together exceptional scholars from across the University to study systemic risk and market integrity from interdisciplinary perspectives. Our work is helping regulators to mitigate risk, reduce market distortions, and help make the financial system safer and fairer.

Michael S. Barr, Co-Faculty Director of the Center on Finance, Law & Policy

Systemic risk & market integrity

From its creation, the Center on Finance, Law & Policy has been grounded in advancing academic research to understand the causes of past financial crises and to prevent the next one.

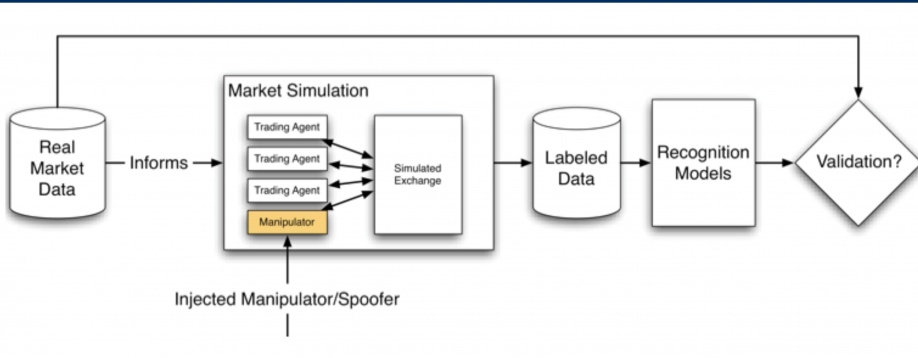

Our interdisciplinary work to promote a stable and fair financial system examines systemic risks and opportunities. Michigan faculty and students are studying AI market manipulation, regulatory structures surrounding cryptocurrency and blockchain, cybersecurity, and the challenges and rewards big data offers. Through our conferences, we cut across silos and bring people together to discuss new ideas. We write academic papers, engage students across disciplines, and actively engage with regulators and policymakers to expand knowledge around these issues.