Algorithmic market manipulation

Summary

By combining finance, machine learning, and computational game theory with law and policy, University of Michigan faculty from the College of Engineering, the Ross School of Business, the Law School, and the Ford School of Public Policy are building new models for thinking about and detecting spoofing and other manipulation.

Funding partners

Funded by the National Science Foundation, the project brings together faculty members from The University of Michigan College of Engineering and Computer Science, the Ross School of Business, the Law School, and the Ford School of Public Policy; these groups work in concert with faculty from the Georgia Institute of Technology.

Project Overview:

The Market Manipulation Project represents a multidisciplinary effort to modernize enforcement mechanisms against manipulative trading activity in large capital markets.

There are two components to this project: (1) developing methods of detecting manipulative activity, and (2) updating legal and regulatory frameworks to enable more effective and precise enforcement against new forms of market manipulation.

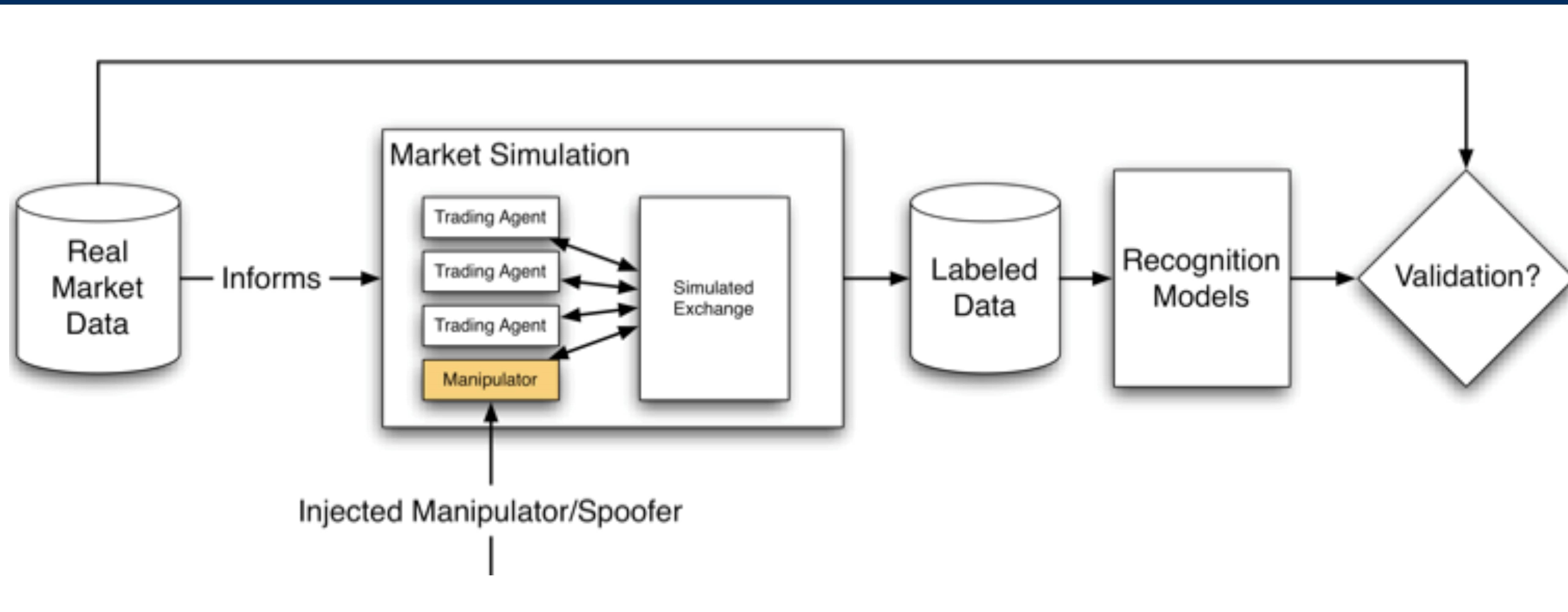

The primary target is ‘spoofing’–the act of placing trade orders without the intent of execution in order to influence market prices. The Issue The vast majority of all orders sent to exchanges are cancelled, which makes it difficult to distinguish spoofing from innocent trading activity. The Project aims to develop improved detection methods through a three-step process. First, the Project will construct manipulation strategies that could theoretically yield profits in the real world. Those strategies will then be executed in a simulated exchange built from actual market data. The Project will examine actual market data to try and infer the extent of spoofing, and will use machine learning to discover signals that will permit algorithms to detect spoofing in real exchanges and in real-time. Improved identification and detection will complement the second component of the Project. An empirical understanding of the incidence of spoofing will help to draw sharper and more workable distinctions between innocent activity and manipulative strategies subject to enforcement.

Better detection methods will guide recommended revisions to legal definitions relating to market manipulation. Such definitions currently over-rely on notions of fraudulent intent that do not translate well to the new world of computer program driven market manipulation. Superior detection will also provide enforcers more compelling data that will strengthen their cases against suspected manipulators. Thus, the Project hopes to yield new and robust strategies for detecting and enforcing against novel forms of market manipulation.