A Central Bank Experience During COVID-19

Note: As part of the Central Bank of the Future research project, we asked a few people to help us think big in reimagining the Central Bank of 2070. What underlying assumptions would have to change to foster economic inclusion? This post is the first article in our "What If...?" blog series.

By Daniel Gersten Reiss

João Manoel Pinho De Mello

October 20, 2020

The lack of supporting documents has been reported as a significant obstacle to micro, small, and even medium-sized enterprise (MSME) receiving credit. As MSMEs have relatively weaker controls, they are unable to produce reliable data about their activity to a larger extent. When they are able to produce data, these data are usually not easily verifiable. The wider information failure narrows the odds that MSMEs will obtain bank lending. The traditional response to this fact is to resort to qualitative information, requiring a much closer relationship between banks and credit candidates. Policies, therefore, usually focus on strengthening credit unions and niche banks.

At the same time, central banks utilize a wide variety of data to forecast the economy, aim monetary policy management, and monitor the financial system’s soundness. In the pursuit of these objectives, central banks develop unique databases, which are frequently composed of data collected by the central banks themselves. What if these data were used to tackle the MSMEs’ shortcomings?

For over a decade, collected credit information has been made available by the Brazilian regulator to banks for the purpose of analyzing clients’ credit [1]. However, the outstanding credit balance helps only to determine the client’s available credit capacity. It is of little help for underdocumented MSMEs, as determining their credit capacity is itself the core issue.

Necessary safety measures for guaranteeing community health against COVID-19 have been in place for several weeks in most jurisdictions, causing atypical economic suspensions. Dealing with these suspensions made governments implement rescue programs. If during regular times, reaching smaller businesses is a case for development, during the pandemic, it became a significant challenge to be beaten.

In Brazil, the consequences of the COVID-19 fight were no different than everywhere else, and the government took the stage by adopting economic measures. Alongside many other responses, the Peac-Maquininhas program focused on supporting the recovery of micro and small firms by better enabling the extension of credit to them [2]. In a nutshell, the program consists of government lending, distributed via traditional credit contracts signed between clients and banks. The previous, long-time challenge then presented itself – how to reach these firms and assess their credit capacity? How to collateralize their operations? Payment solutions were the answers provided to both questions; we focus here on the answer to the former [3].

The Operational Answer

Card payments have been centrally cleared and settled in Brazil since 2017. Following international standards, the central bank monitors the privately-owned system that settles these transactions and, as a result, accumulates a large amount of data. These data include acquiring banks’ payments to merchants — that is, the firms’ sales history of card-related payments.

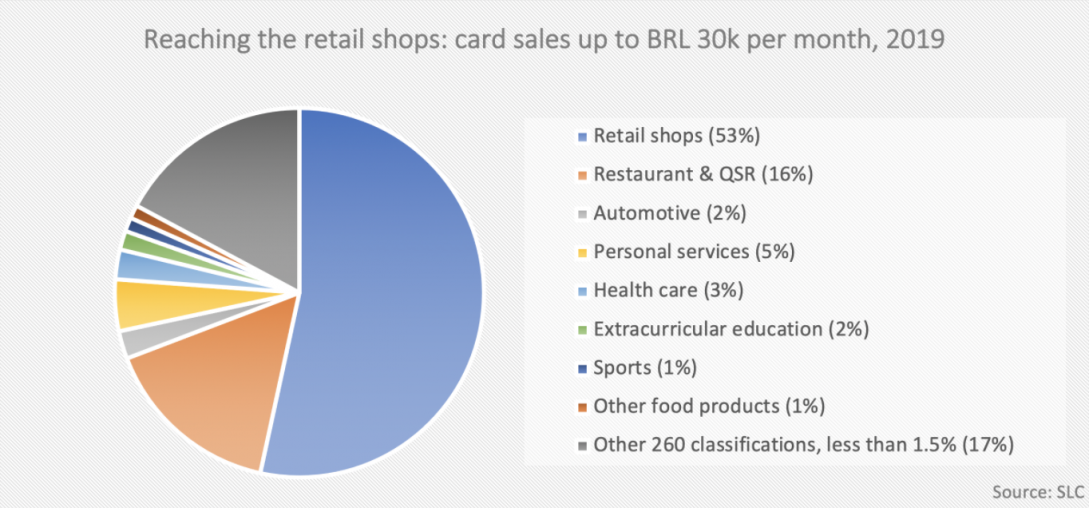

Of the 2.6 million micro and small firms receiving card payments, roughly one-third consist of mom-and-pop shops [4]. The distribution of these firms by their main economic activity is shown in the following graph.

The detailed figures confirm the link between card payments and less sophisticated firms, which we assume to result from limited access to credit due to the under-documentation argument presented above. Seventy percent of the potential borrowers consists of retail shops or restaurants. Automotive and personal services, health care, extracurricular education, and sports activities follow, consisting of the next 14%. The remaining 17% is spread among 260 different activities. These activities are expected to make up the previously discussed target group.

Arguably, merchants’ banks would also have information on a given firm’s cash flow and would be able to direct government-subsidized credit. This argument does not hold, as a merchant’s data is frequently split across financial institutions. Having a relationship with more than one bank is not uncommon even among smaller firms, and migration across institutions is also not uncommon. In addition to this setup, the private clearinghouse that settles card payments do not provide data aggregation services to end-users, nor is any open banking initiative yet in place.

Therefore, the compilation of card payment history from oversight data must have fulfilled the credit documentation gap within the program’s model. It supported the targeted micro and small firms with a reliable source of information for credit analysis.

The Central Bank of the Future

Big data, when related to central banks, has been treated as being under the SupTech brand. The Bank for International Settlement’s Financial Stability Institute considers SupTech to be the use of modern technology by regulators to support their own work [5]. The data used in the SupTech context have a broader potential. The operational answer provided during COVID-19 is an example of how these data can contribute to mitigating one financial access challenge.

By taking data which are used in the central banks’ traditional oversight role and using it to achieve competition or inclusiveness goals, a discussion follows regarding the additional roles central banks may play. This debate requires discussing whether such roles exceed central banks’ traditional macroeconomic responsibilities and pushes monetary authorities towards microeconomic duties.

Improving micro and small business credit documentation, as was done with Peac-Maquininhas, results in neglectable additional costs, as this solution builds on an existing communication infrastructure between the regulator and the banks. When contrasted with the potential outcomes of broader credit access and potential additional market competition, the benefits outweigh the costs. Nonetheless, the expansion of central bank activities’ scope shall always require caution, as cohesion is fundamental to any organization, including central banks.

Conclusion

Program results are yet to come and to be assessed. Undeniably though, a new use for central bank oversight data has been established. A step through which better extension of financial products to smaller agents has been provided.

Daniel Gersten Reiss is Advisor to the Deputy Governor for Licensing and Resolution at the Central Bank of Brazil and a researcher at the Economics and Politics Research Group, University of Brasilia.

João Manoel Pinho de Mello is the Deputy Governor for Licensing and Resolution for the Central Bank of Brazil, and a full professor with Insper.

-+-+-+

[1] Data sharing is always subject to prior and specific client’s consent.

[2] Peac-Maquininhas is a combination of the Portuguese acronym for Emergency Program for Credit Access (Peac) with the word Maquininhas, which relates to the POS terminals used for card sales.

[3] The collateralization solution resorted to the new framework for cards’ receivables and has already been scheduled for November 2020. Repayments are to be automatically handled as acquiring institutions shall pay bank loans directly according to daily card sales. This exciting mechanism is beyond the scope of this post.

[4] Approximately 90% of micro and small firms receive card payments through a scheme that settles via the clearing system. Some schemes – mostly e-money wallets – are exempt from clearing on a firm-by-firm basis. The remaining 10% of firms, for which there is no firm-level oversight data, receive through these systems and are not able to access the government aid.

By Daniel Gersten Reiss, Advisor to the Deputy Governor for Licensing and Resolution at the Central Bank of Brazil and João Manoel Pinho de Mello, Deputy Governor for Licensing and Resolution for the Central Bank of Brazil